Homeowners Insurance in and around Tulsa

If walls could talk, Tulsa, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

With your home covered by State Farm, you never have to fret. We can help you make sure that in the event of damage from the unpredictable tornado or burglary, you have the coverage you need.

If walls could talk, Tulsa, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Safeguard Your Greatest Asset

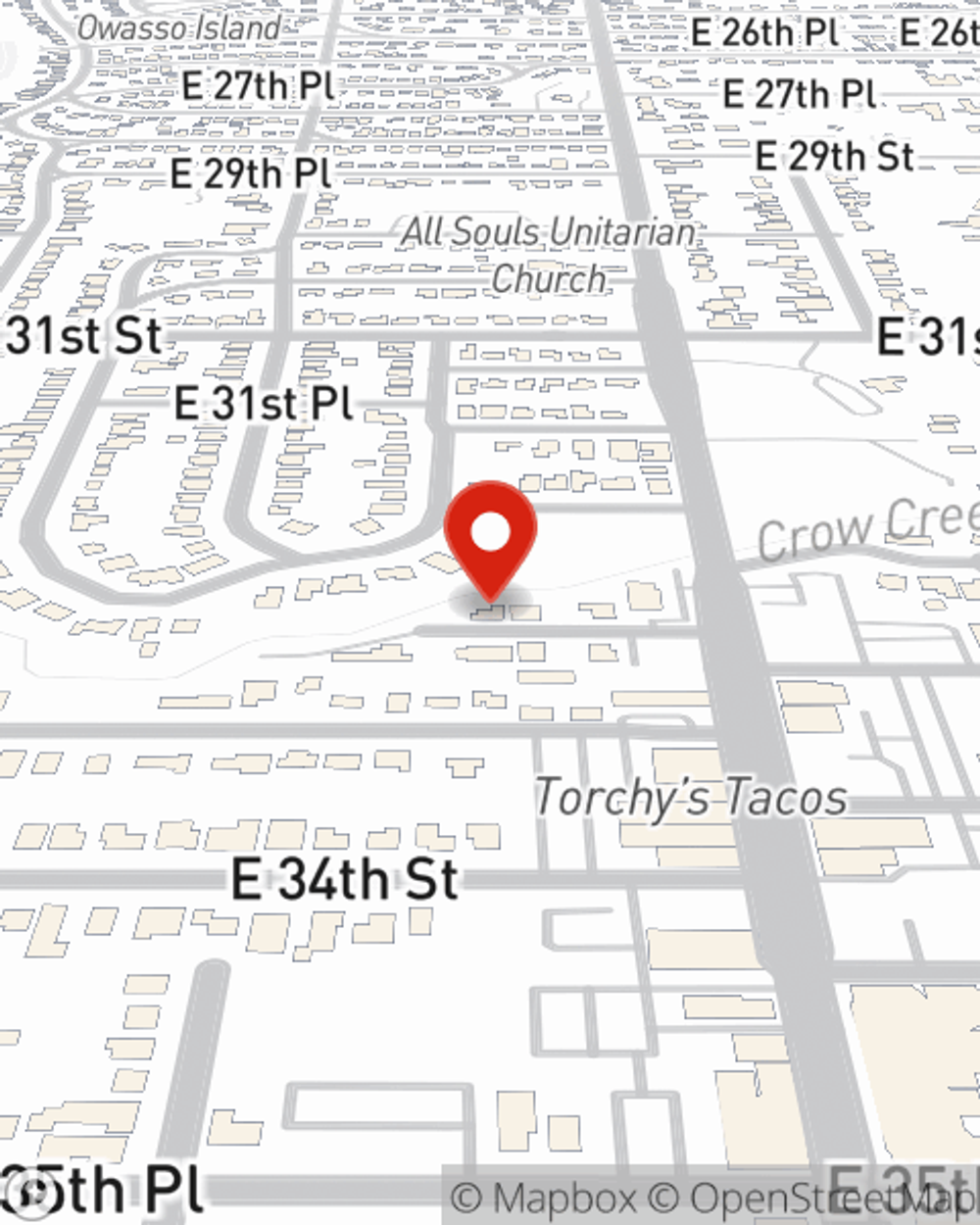

Great coverage like this is why Tulsa homeowners choose State Farm insurance. State Farm Agent Chuck Sloan can offer coverage options for the level of coverage you have in mind. If troubles like identity theft, service line repair or drain backups find you, Agent Chuck Sloan can be there to help you file your claim.

Call or email State Farm Agent Chuck Sloan today to learn more about how a top provider of homeowners insurance can help protect your home here in Tulsa, OK.

Have More Questions About Homeowners Insurance?

Call Chuck at (918) 492-7600 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Chuck Sloan

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.